tax benefit rule definition and examples

If you receive. Legal Definition of tax benefit rule.

Types Of Preference Shares Learn Accounting Accounting Principles Financial Literacy Lessons

If the amount of the loss was not taken as a deduction in the year the.

. Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must pay tax upon it if it was not counted in their taxable earnings in a previous year. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the money must be treated as taxable income. An Essay on the Conceptual Foundations of the Tax Benefit Rule Patricia D.

The rule is promulgated by the Internal Revenue Service. Benefits Received Rule. 489 1943 and Central Hanover Bank Trust Co.

A tax benefit is an allowable deduction on a tax return intended to reduce a taxpayers burden while typically supporting certain types of commercial activity. That results in a 400 difference which is your tax benefit. Example of the Tax Benefit Rule.

The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event depend in some degree on the prior related tax treatment. In the example above Company XYZ could. Definition Tax Code Examples Imputed Income.

COMPLETE YOUR TAX FORMS FREE WITH E-FILECOM FREE EDITION. Of the 1000 refund you receive from Iowa 400 of it will be taxable on your 2017 federal return. In December 2017 as part of the Tax Cuts and Jobs Act PL.

However in 2012 the taxpayer receives a state tax. Tax benefit rule definition April 25. Using tax software or working with a qualified tax professional can.

Tax benefit rule definition and examples. Examples of tax benefit. Significant tax savings can be obtained by understanding recognizing and applying the tax benefit rule.

Of the 1000 refund you receive from Iowa 400 of it will be taxable on your 2017 federal return. Jones recovers a 1000 loss that he had. Tax benefits include tax credits tax deductions and tax deferrals.

The tax benefit rule states that the amount included in gross income is limited to the amount the taxpayer received a. The tax benefit is the lessor of the actual deduction claimed or the amount the deduction causes your total itemized deductions to exceed your applicable Standard Deduction amount. Tax benefit rule n.

In the above example the taxpayers AGI was reduced by 24323 resulting in a tax savings of at least 480 and possibly as high as 1200 if deductible medical expenses are affected. Two examples of the rules early application are Dobson v. Note however that the tax benefit rule does not prevent companies from taking advantage of changing tax rates it doesnt protect them either.

When deferment ends only 90 percent or 214200 is owed saving 23800 in capital gains taxes. If the amount of the loss was not taken as a deduction in the year the loss occurred the. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period.

There are exceptions to this principle which if exploited can reduce tax bills. Plumb The Tax Benefit Rule Tomorrow 57 HARV. Examples of this include educational assistance programs which are tax free up to 5250 in the 2019 tax year and transportation benefits which are.

A tax benefit allows. Tye The Tax Benefit Doctrine Reexamined 3. Other example is a claim against the taxpayer such as a local property tax or an employees salary which is deducted when paid.

Some tax benefits can show up directly on your paycheck whereas others have to be claimed on your tax return. Its quick easy secure. Tax Benefit Rule 55 TAXES 321 1977.

White Georgetown University Law Center Follow this and additional works at. The tax benefit rule is codified in 26 USC. Example of the Tax Benefit Rule.

A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction. Definition of Tax Benefit Rule If you recover a cost that you had deducted in a previous year you must include it in your income in the year that it is recovered.

Gross income does not. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later and not paying taxes on it.

A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a subsequent yearthe money must be counted as income in the subsequent year. Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax deduction versus the 13000 you actually claimed. The tax benefit rule is a feature of the United States tax system.

Legal Definition of tax benefit rule. Plumb The Tax Benefit Rule Today 57 HARV. The commuting use of an employer-provided automobile.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction NOTE. This common example has many variations. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011.

The way to look at the rule is what would your tax return have looked like if you had NOT claimed the. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit.

Learn English Grammar With Pictures 15 Grammar Topics Eslbuzz Learning English Essay Writing Skills Learn English Grammar Comma Rules

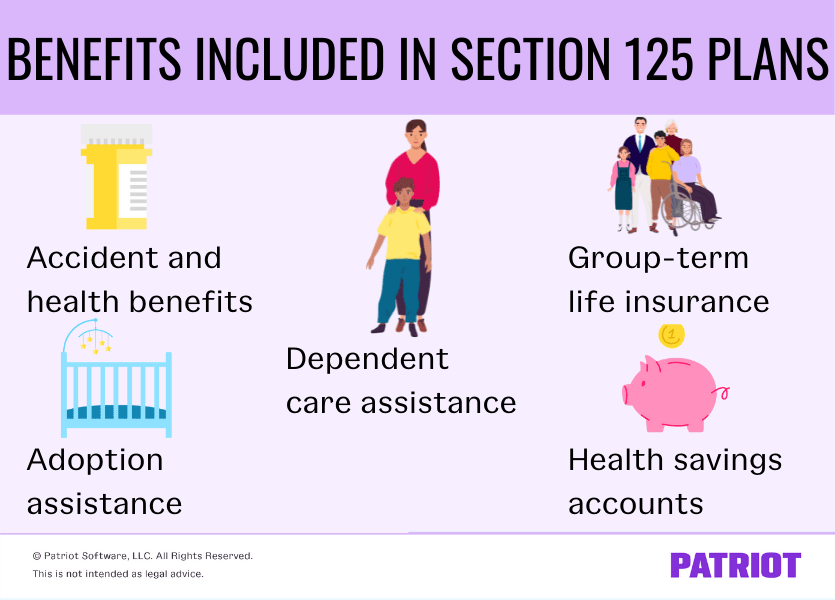

What Is A Section 125 Plan Definition Benefits More

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Tax Advantages For Donor Advised Funds Nptrust

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

:strip_icc()/claiming-adult-dependent-tax-rules-4129176_updated-f6071c45f647429d8fa9a9dc58c0cd74.gif)

Tax Rules For Claiming Adult Dependents

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Is The Standard Deduction Tax Policy Center

What Are Marriage Penalties And Bonuses Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

What Is The Standard Deduction Tax Policy Center

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

Backflush Costing Meaning Process Drawbacks And More Accounting Principles Cost Accounting Accounting Education

/TaxBenefit-45ba63a4dbdc40f791f03795102d611f.jpg)